I came across a headline today: “Fed Rate Cut Grows More Likely as Inflation Holds Steady at 2.7%.”

Naturally, that raises the million-dollar question for consumers: What does this mean for me?

In real estate, timing is everything — or at least we like to think so. When’s the right moment to buy? When should you sell? If only we all had a crystal ball that actually worked.

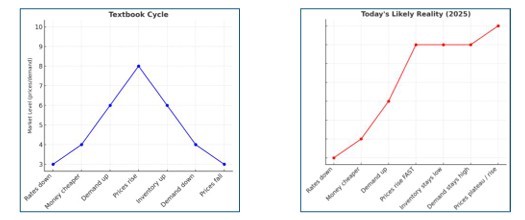

Economics textbooks paint a neat picture of how rate cuts should work:

• Rates go down → Money gets cheaper → Demand goes up → Prices rise → Inventory increases → Demand cools → Prices fall.

But here’s the problem — real estate cycles don’t operate in neat loops. They’re slower, full of lags, and shaped by unique market conditions.

In 2025, we’re in a market with low inventory and sellers “locked in” to ultra-low mortgage rates. Many

homeowners paying 2–4% interest on their loans have little reason to sell, even if prices rise.

That means if the Fed cuts rates, the “textbook” cycle could break down. Instead of inventory rebounding and prices eventually falling, we might just see more buyers chasing the same limited pool of homes — driving prices higher and keeping them there.

That brings us to two very different cycles — the one the textbook predicts, and the one we’re more likely to see in today’s market.

Where should you be on this cycle?

• Buyers: If rates drop, you may have a short window before prices react upward.

• Sellers with a 2–4% loan: You’ll likely stay put unless life forces your hand.

• Other sellers: If you can wait, lower rates might deliver a bigger pool of buyers — and better offers— in the near future.

The bottom line: The “perfect” time to make a move depends on your personal circumstances, not just the Fed’s next announcement.