A Prequalification Letter (Prequal letter) is a letter written by a mortgage broker / lender intended for use between the Buyer and the Seller in a real estate transaction. The Buyer traditionally will submit a Prequal Letter with an offer to purchase a property indicating to the Seller that the Buyer has already talked to a mortgage broker, answered many personal financial questions and both his front-end and back-end DTIs (Debt-to-Income Ratios) have been calculated and determined to be within traditional lending guidelines with regards to the Buyer’s credit, income and assets. This letter is designed to give the seller comfort in knowing that this particular Buyer initially meets the necessary borrowing guidelines and should qualify for a new home loan.

Do not confuse a prequal letter with a Preapproval Letter. A Preapproval letter is different in that it is more than a cursory examination of the buyer/borrower’s credit, finances and DTIs. The buyer/borrower will have already gone through the formal under-writing process and both the buyer/borrower and the property have been approved by the bank. A Preapproval Letter is a commitment from the bank to make the loan according to the terms of the purchase agreement.

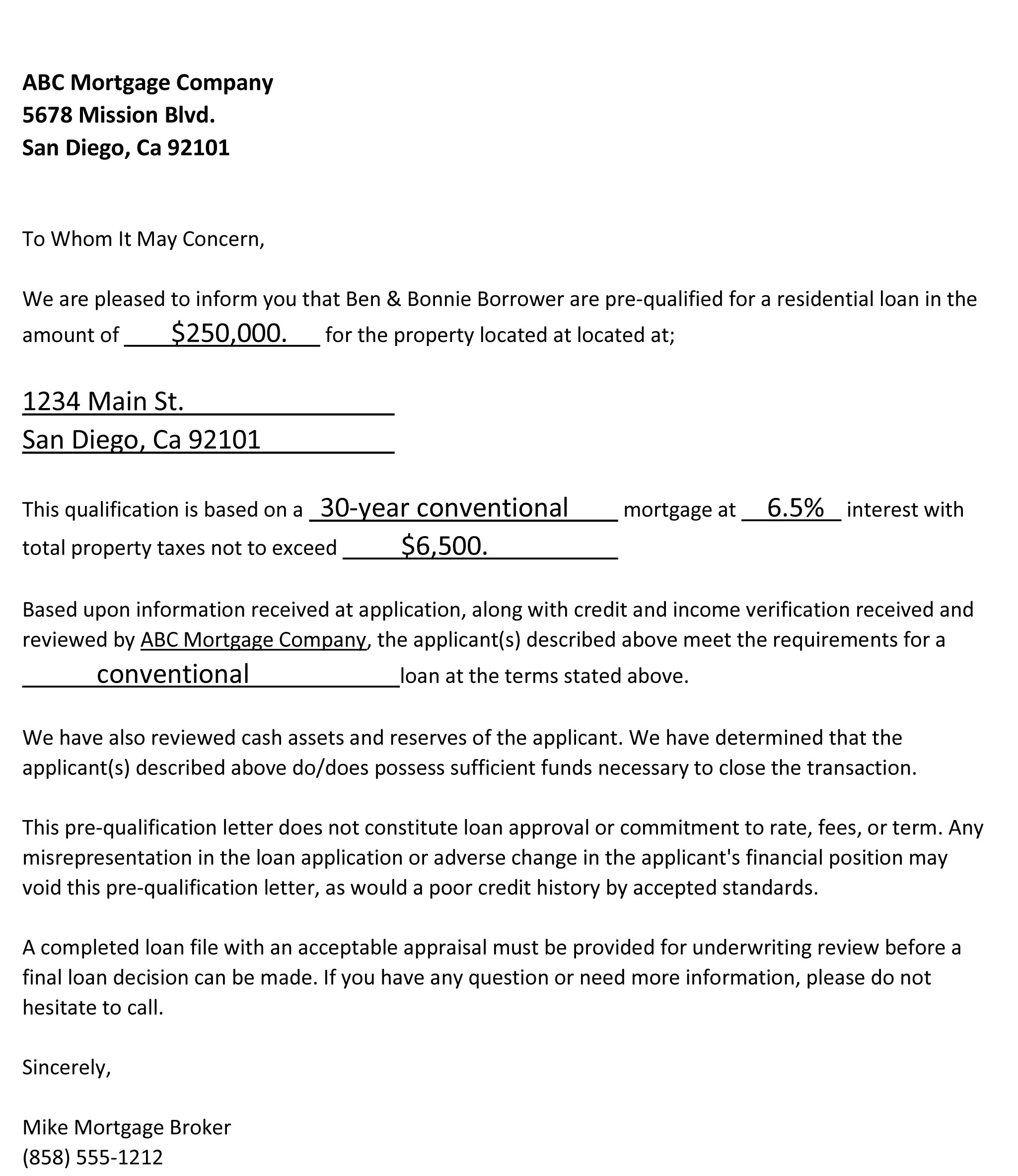

See a sample Prequalification Letter below: