Is a Home Warranty the Same as Homeowners Insurance?

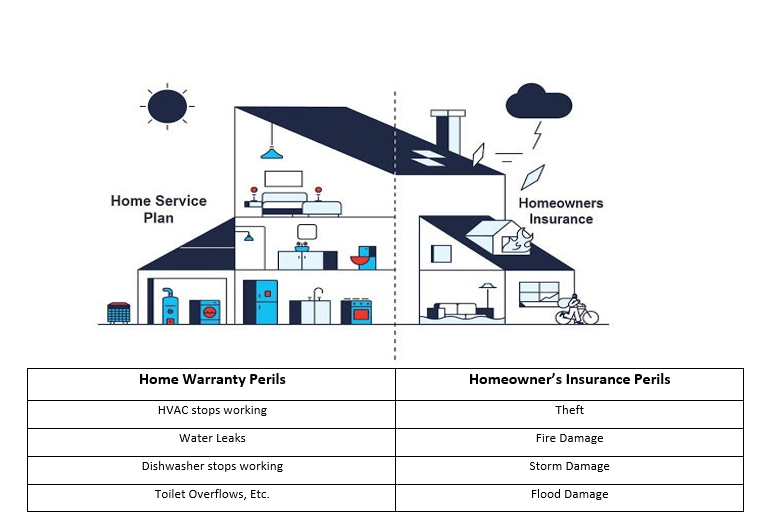

A home warranty isn’t a replacement for homeowners’ insurance. A home warranty covers service, repair, or replacement of your home’s major systems such as HVAC, electrical, and plumbing. It can also cover major appliances like your refrigerator or dishwasher. Typically, a premium is paid for a one-year term. This type of warranty is issued by a home warranty company and is different from homeowners’ insurance

By contrast, homeowner’s insurance covers damages or loss due to known perils, which could include wind, fire, vandalism, hail, or theft and provides financial protection in all these cases. Standard homeowners’ insurance policies insure a home’s structure and belongings in case of a “known peril” listed in the contract, such as the ones listed above.

If a tree falls on your air conditioning unit – a sudden and fortuitous event due to a peril, wind – that is an insurance claim. If your air conditioner stops blowing cold air, you can use a home warranty plan.

A home warranty complements homeowners’ insurance by covering damages that home insurance policies don’t. Home warranties aren’t as crucial or mandatory as homeowner’s insurance, though there is a strong argument that says anyone who owns a home should consider a home warranty because it’s an extra layer of protection that can alleviate the financial burden of unexpected system/appliance repairs and replacements.

In summary, home warranties and home insurance are both important tools that can reduce the risk and potentially the financial burden of home ownership, but the two contracts cover different issues.

To discuss this article or any other real estate topic, please contact us any time.